31+ Georgia Intangible Tax Calculator

The tax rate is 150 for each 50000 or fraction thereof of the face amount of the note. Web The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan.

Film Investment Group Savannah Ga

Ad Filing Taxes Yourself Just Became Easier With TaxActs DIY Tax Filing Software.

. After a few seconds you will be provided with a full. Web Does Georgia have intangible tax. Try Our Free And Simple Tax Refund Calculator.

Web The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Web In Georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers. The intangible tax is based on the loan amount not the purchase price.

The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of. Web Intangible Recording Tax Forms 989 KB Set of forms includes the Georgia Intangible Recording Tax protest form and claim for refund form. While Georgia has one of the.

Web To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Web What Is Georgia Intangibles Tax. Web What is intangible tax in GA.

225000 x 80 180000 amount of loan. Web The loan is 80 of the purchase price. It is a tax on long-term notes secured real estate.

Web Georgia Title Insurance Rate Intangible Tax Calculator Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. PTR-1 Report of Intangible Tax.

Backed by our 100k Accuracy Guarantee Your Maximum Refund Is Guaranteed. The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan. Web Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at 150 per five hundred 300 per thousand based upon the amount of loan.

Web A financial advisor in Georgia can help you understand how taxes fit into your overall financial goals. 100 Accurate Calculations Guaranteed. Financial advisors can also help with investing and financial plans.

The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan. This tax is based on the value of the vehicle. Web Does Georgia have intangible tax.

A property financed for 55000000.

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Georgia Income Tax Calculator Smartasset

Meeting The 21st Century Surveying Geomatics Education Needs Of Gdot And Georgia Digital Library Of Georgia

How To Pay States Taxes Online New York California Etc

Teleport Communications Atlanta Inc Georgia

Pdf Predicting Intentional And Inadvertent Non Compliance Ju Sung Lee Academia Edu

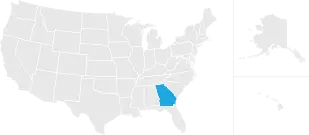

Georgia Tax Calculator

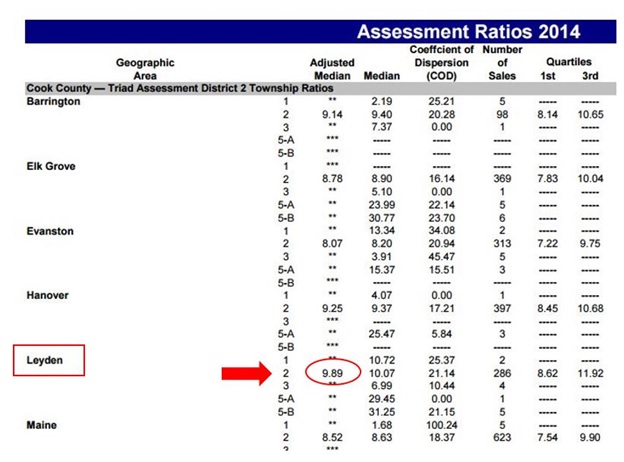

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Pdf Icesr2013 Book Of Proceedings International Conference On Environmental Studies And Research Mala Mukherjee Academia Edu

Tax Calculator Launches In Georgia Eurofast

Tax Rates Gordon County Government

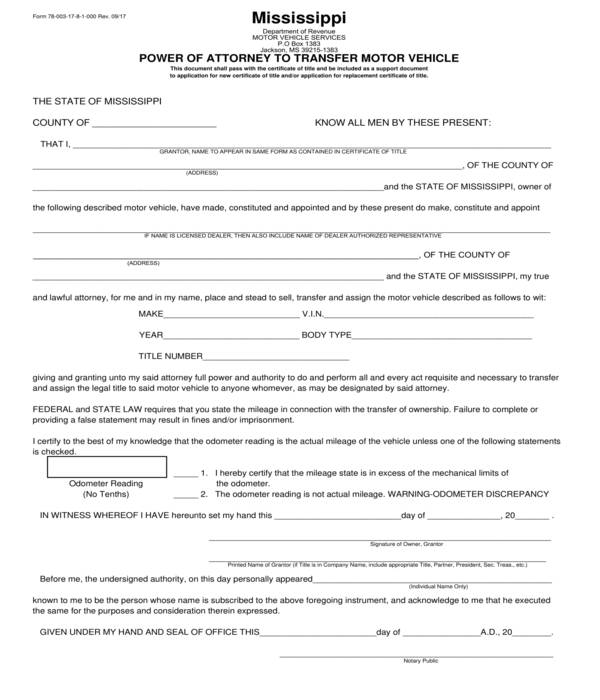

Free 8 Vehicle Power Of Attorney Forms In Pdf Ms Word

Georgia Paycheck Calculator Smartasset

Foreign Investment In Real Property For Immigration Purposes Ppt Download

Foreign Investment In Real Property For Immigration Purposes Ppt Download

Georgia Property Tax Calculator Smartasset

Energies Free Full Text Trade In The Carbon Constrained Future Exploiting The Comparative Carbon Advantage Of Swedish Trade